Everyone agrees that the sequester, an $85 billion cut from the planned increase for this fiscal year, applied across the board within the broad categories of Defense ($42.5 billion) and non defense discretionary ($42.5 billion) is the worst way to allocate cuts. This is apparently why President Obama proposed it as a sort of poison pill. (See Bob Woodward: bob-woodward-obamas-sequester-deal-changer/). Indeed it is. Little else is clear about the sequester. It is worth clarifying the facts and context of the size of the cuts and their distribution after a quick review of how we got here.

Background

Republicans want to bring federal government spending down to traditional levels, which can be fully financed with existing taxes, while Democrats want to raise taxes to finance a larger government (currently at 24.3 percent of GDP reflecting, in part, great recession related factors, and averaging 19.8 percent from 1960 to 2007). Many efforts have been made to forge a compromise package that would be accepted by both the Republic majority House and the Democrat majority Senate. So far, none has succeeded.

Three years ago President Obama established a bipartisan budget reform commission—Bowles-Simpson commission, which in December 2010 recommended spending cuts and tax increases that would slow down the ballooning of debt over the next ten years by 4 trillion dollars, 3 trillion in spending cuts and 1 trillion in tax increases (largely from closing tax loopholes). As the base line projected increase over that period was $10 trillion, the Bowles-Simpson proposals would hold the increase in the debt to $6 trillion. Sorting out what Bowles-Simpson actually proposed became so complicated (e.g., they actually used an eight year period rather than ten and for incomes over $250,000 assumed a return to pre-Bush tax cuts rates) that even President Obama ignored the report. http://www.cbpp.org/cms/index.cfm?fa=view&id=3844

Soon thereafter (January 2011) three Republican and three Democrat Senators, the so-called gang of six, began discussions to find an acceptable compromise, eventually announcing failure in May of that year. Later that same year the Bipartisan Policy Center’s Debt Reduction Task Force co-chaired by Pete V. Domenici, former Republican U.S. Senator from New Mexico, and Alice M. Rivlin, founding director of CBO, former OMB director, and former Vice Chairman of the Board of Governors of the Federal Reserve, made similar recommendations.

On several occasions President Obama and Speaker of the House, Republican John Boehner, were close to a “grand bargain” that included some tax revenue increase and entitlement cuts. Efforts failed when Boehner concluded that he could not obtain enough Republican votes in the House. The President may have had the same problem with his party in the Senate if he had tried to present it to them. Other efforts, such as one led by Vice President Biden, met similar fates.

To avoid the sharp curtailment of government spending that would result from hitting the debt ceiling, preventing any further government borrowing in late 2011, the Budget Control Act of 2011 increased the authorized debt ceiling by $2.3 trillion and cut $841 billion from the projected deficit increase over the next ten years by capping the annual increases in discretionary spending over that period. The caps do not constrain increases in war related expenditures (Afghanistan), natural disasters, or entitlements. It also established as special joint committee of Congress charged with agreeing on an additional $1.2 trillion in deficit reduction over the next ten years with everything on the table (entitlements and defense cuts, tax increases, etc). If this so-called Super Committee was unable to reach an agreement or Congress did not approve it, the same amount would be cut according to the now infamous sequester. (Super Committee Sequestration) The sequester provision was deliberately meant by all sides to be so unpalatable that the Super Committee could not possibly fail to reach a compromise.

However, on November 20, 2011, the co-chairs of the Super Committee stated that “after months of hard work and intense deliberations, we have come to the conclusion today that it will not be possible to make any bipartisan agreement available to the public before the committee’s deadline.”

Two things were scheduled to happen if nothing changed. First, $1.2 trillion of automatic across-the-board spending cuts would kick-in on Oct 1, 2012. Second, the Bush tax cuts would expire for everyone at the end of that year. In addition, the temporary cuts in the payroll tax and the extension of unemployment benefits might not be continued. These three items constituted the infamous fiscal cliff, which was averted at the last-minute by making the Bush tax cuts permanent for everyone except those with incomes above $400,000, indexing the Alternative Minimum Tax and a few other things. The start of the sequester was delayed until January 1, 2013 and then again until March 1. This is a very simplified summary (trust me) of how we got to the sequester.

The Sequester

The sequester does not reduce total spending. Total Federal government’s spending in 2012 was $3,538 billion and planned spending (no actual budget has been approved for three years) for 2013 (which ends September 30) was (before the sequester) $3,796 billion. Reducing this amount by the $85 billion as required by the sequester still leaves an increase of $173 billion, which even after adjusting for inflation is a real increase. http://www.usfederalbudget.us/federal_budget_estimate_vs_actual

The often misleading practice in Washington of referring to reductions in increases as “cuts” is illustrated by the following statement by Sen. Bernard Sanders (I-Vt.), a member of the Budget Committee: “Some of us believe very strongly that it would be absolutely wrong to cut Social Security benefits.” He was referring to the proposal offered by President Obama to John Boehner to shift the index used to increase Social Security benefits over time to one that would increase them more slowly (the chain CPI index, which would preserve the real value of benefits). Senate-democrats-budget-challenges-obama-on-medicare-social-security-cuts

While the sequester does not cut total spending, the way in which it is allocated does cut spending in some areas. Half of the cut comes from Defense, which was already being cut (cuts that actually reduce spending below the previous year) before the sequester. The other half of the cut falls on discretionary spending (sparing the entitlements – social security, Medicaid, etc, and the Department of Veteran’s Affairs). As such non-military discretionary spending is only about 15% of total spending, taking half of the total cut from items that are only 15% of the total is about an 8% cut. These figures apply to this year only. Like this year’s “cuts,” the sequestered spending over the next ten years are to be taken from the ever-increasing base line amounts and thus just slows down the previously planned increases.

The Budget Control Act of 2011 also specified that within the categories identified above, the cuts must be applied across-the-board (i.e. proportionally) to each Budget Account (BA), of which there are 1200, and each of which consolidates a number of programs, projects and activities (PPA). Within each Budget Account, the executive branch of government is responsible for prioritizing the cuts, i.e. for cutting those things least valuable (most wasteful). The government rarely spends money on things that have no value at all (some of my friends will challenge me on this statement), but that is not the correct standard of judgment. The correct standard (in part) is whether the money spent on a valuable project would have produced even more value if spent on something else (whether by the government or the taxpayer).

To review, the President proposed the cross the board cuts to defense and non-defense discretionary spending and Congress accepted the idea in the Budget Control Act of 2011 believing, with the President, that it would never need to be applied. However, we are now there and the cuts must be made. But within the cuts required for each Budget Account, it is the Administration that is responsible for what to cut. Like the CEO of any company faced with limited resources, Department heads are responsible for cutting those activities of least value and preserving those of greatest value.

Smoke

Any cut hurts someone even if it benefits the economy over all. Consider, for example, the loss of four air traffic controllers at the Garden City, Kansas airport. “THE $85 BILLION in across-the-board budget cuts known as sequestration have begun to affect places like Garden City, the Kansas county seat (pop. 26,880) whose airport will lose $318,756 in Federal Aviation Administration funds that pay for four air traffic controllers. As The Post’s Stephanie McCrummen reported, Garden City Regional Airport’s control tower is one of 238 affected by sequestration, which will reduce total FAA spending in fiscal 2013 from about $16.7 billion to $16.1 billion. Small towns are lamenting the potential impact on air safety and local economies.” A Washington Post editorial on March 8 notes that of the two commercial flights that take off and land there each day one already does so when the control tower is closed (Small-town-airports-propped-up-with-200-million). The Post concludes that the $200 million a year the federal government spends to subsidize commercial flights to small lightly used airports is a waste that deserves to end.

A considerable fuss was raised about the Administration’s cutting the White house tours. Was this the least costly cut from the White House or Secret Service budget? I have no idea. The Washington Post editorialized that: “THE DECISION to drop White House tours always had a whiff of what’s known as Washington Monument syndrome. The ham-handed tactic is employed when government is faced with budget cuts and officials go after the services that are most visible and appreciated by the public.” (Reopen-the-white-house-to-tourists) The government could not threaten to close the Washington Monument because it has already been closed for several years for repairs from earthquake damage.

On the other side of the ledger, the Administration’s release of non dangerous illegal immigrants held in federal prisons is more likely a case of doing what the Administration and many others consider the right thing to do anyway and using sequestration as an excuse (the release was weeks before the sequestration). Wasting-money-lives-through-the-detention-of-immigrants

The proposal to cut back on Congressional junkets abroad was made by a columnist, not the administration for obvious reasons. Everyone can find their own favorite wasteful spending. Budget decisions are never easy and resources are always limited so careful prioritization is a normal and essential part of the management of any organization.

Lies

Then there were the claims of cuts that never occurred. Education Secretary Arne Duncan’s false claim of pink slips for teachers earned him 4 Pinocchios (big lie) from The Washington Post’s Fact Checker. And Duncan is one of the good guys: 4-pinocchios-for-arne-duncans-false-claim-of-pink-slips-for-teachers

On March 1 at his press conference President Obama stated: “Starting tomorrow everybody here, all the folks who are cleaning the floors at the Capitol. Now that Congress has left, somebody’s going to be vacuuming and cleaning those floors and throwing out the garbage. They’re going to have less pay. The janitors, the security guards, they just got a pay cut, and they’ve got to figure out how to manage that. That’s real.” But it wasn’t. It also received 4 Pinocchios from the Fact Checker. sequester-spin-obamas-incorrect-claim-of-capitol-janitors-receiving-a-pay-cut

The Congressional janitors seemed to be a particular concern of the administration. Gene Sperling, director of the White House economic council, on ABC News’ “This Week,” March 3, 2013 observed: “You know, those Capitol janitors will not get as much overtime. I’m sure they think less pay, that they’re taking home, does hurt.”

On March 4, White House spokesman Jay Carney observed at his news briefing: “On the issue of the janitors, if you work for an hourly wage and you earn overtime, and you depend on that overtime to make ends meet, it is simply a fact that a reduction in overtime is a reduction in your pay.” But none of this was true and drew 4 more Pinocchios from the Post Fact Checker. Capitol-janitors-making-ends-meet-with-overtime-nope

Though the President already has the responsibility of deciding where to cut within Budget Accounts, Republicans have offered to broaden the range of his discretion to determine what to cut and what to keep. Senator Toomey (R-Penn) reported this to us at the Heritage Foundation the day after his dinner with the President at the Jefferson Hotel. He and Sen. James Inhofe (R-Okla) have introduced a bill in the Senate to this effect. The President said no thanks. If you believe that the president has the best interests of the nation at heart, this is a shocking revelation. The President seems to prefer to blame the Republicans for forcing harmful cuts on the nation because after having accepted tax increases on the wealthy they refuse to raise taxes more without some cuts in entitlement programs. This was confirmed in a revealing article by Ezra Klein How-to-fix-sequestration-without-raising-taxes

The way forward

The Budget Act of 1974 requires the president to submit a budget request to Congress on the first Monday in February. He has yet to do so (written March 14th). His recent step into the leadership role normally played by Presidents on major budget matters is welcomed and will be essential if compromise is to be achieved.

White-house-delay-budget-proposal-infuriates-republicans. For the first time in three years the Senate is on the way to adopting a budget as well. Given the budget already passed by the House (the Ryan budget), for the first time in several years the two chambers will have written proposals to negotiate, and hopefully reconcile, with each other.

Most Republicans don’t want to raise taxes or cut defense. Most Democrats don’t want to touch entitlements. Most everyone accepts that the current path is not sustainable. “Sen. Mark R. Warner (D-Va.) argued — to the “consternation” of people “on my side,” he said — that Democrats will have to do more to prevent Social Security and Medicare from bankrupting the nation as the population ages. I share the belief of even my most progressive colleagues that Medicare and Social Security are among the greatest programs ever implemented. But I also believe that the basic math around them doesn’t work anymore,” Warner said. The longer we put off this inevitable math problem,” he said, “the longer we fail to come up with a way to make sure that the promise of Medicare and Social Security is not just there for current seniors but for those 30 years out.” (in the previously cited Post article). Demographics alone will dramatically increase Social Security, Medicaid and Medicare spending even if benefits for each person are not increased as the ratio of old and retire people to working people increases dramatically over the next thirty. Increasing immigration, reducing benefits and increasing tax revenue are the only things that can help. Both sides will need to compromise.

My preference is to cut the Defense department a bit more and “cut” entitlements a lot (which would have little to no effect for a number of years but is critical for the future), and modestly increase the State Department and infrastructure repair spending. Medicare and Medicaid will be more difficult because they require structural changes that actually reduce the cost of medical care, not just arbitrary cuts that must be made up by paying customers picking up other peoples’ bills. Social Security is much easer to fix: Saving Social Security

There are many reasons for reducing the size of our government. Keep-it-lean, How-to-measure-the-size-of-government.

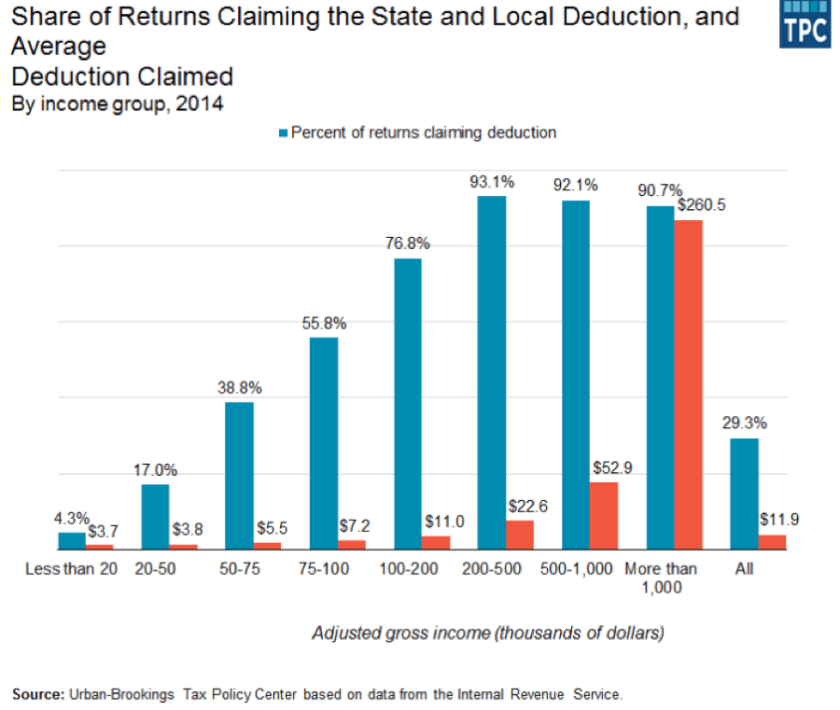

Whether it increases tax revenue or not our tax system needs major overhaul: “US Federal Tax Policy”. At a minimum personal income tax loopholes (deductions) should all be closed and if the corporate income tax can’t be eliminated yet, its rate should be lowered to the levels found in Europe.

But Obama won the last election. I will not get what I want. Republicans will also have to compromise. The battle should be fought over spending. The question should be what government programs and at what level are we willing to pay for with our tax revenue. Some tax increases and spending cuts have already been adopted. More are needed. It is time for Congress and the Executive to get back to their jobs of evaluating priorities and trade offs and develop and adopt a real budget. Hopefully this time they will succeed. Much depends on it.

Congressional Budget Office forecasts

Congressional Budget Office forecasts