The world benefits from rules of interaction that provide peace and cooperation. Rather than building more weapons of war, we could build more temples of beauty. Championing rules most countries respect and aspire to and being the largest (or perhaps second largest) economy in the world, the United States has naturally led such an international order. Retaining that role would be jeopardized if the U.S. did not diplomatically fashion such rules that were embraced and respected by most other countries and if the U.S. did not itself abide by the rules it had championed.

America’s leadership role is being jeopardized by our hypocrisy, such as condemning Russia’s invasion of Ukraine while given a blank check and American weapons for Israel’s invasion of Gaza and Lebanon and ignoring its abuse of its occupied territories in the West Bank of Palestine. America’s embrace of the International Criminal Court’s (ICC’s) arrest warrant for Vladimir Putin for Russia’s invasion of Ukraine and America’s condemnation of the ICC’s arrest warrant for Israel’s PM Benjamin Netanyahu’s and its former Defense Minister Yoav Gallant is the very definition of hypocrisy.

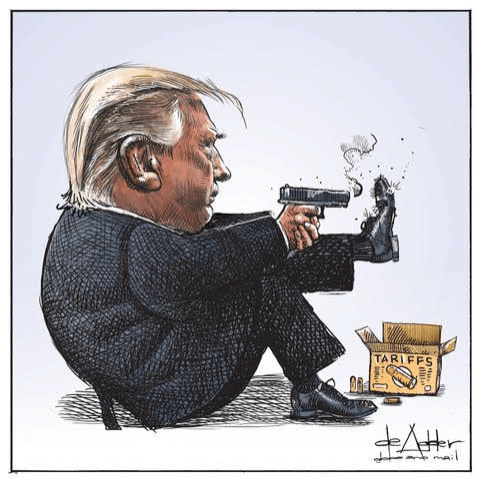

President elect Donald Trump’s style of negotiating international agreements reflects more the behavior of a bully than a diplomat. Last Monday Trump threatened to levy a 25% percent tariff on all imports from Mexica and Canada, despite the large economic harm to the US as well as Mexica and Canada and despite the laws and agreements it would violate, if they did not stop the illegal drugs and aliens entering the US across their borders. WC: “tariffs”

“Trump’s threat spurred outrage across the northern and southern U.S. borders, prompting backlash and warnings of retaliatory tariffs from both Mexico and Canada.” The Hill: “Takeaways from trumps new tariff threat”

“Donald Trump’s angry threat to impose 25 percent tariffs on all U.S. imports from Mexico… is widely being depicted as a bluff….

“But amid all this parsing of Trump’s intentions, a crucial fact about his new move is getting lost: At the center of it is a lie. This lie is hiding in plain sight: It’s the underlying suggestion that Mexico is not doing anything to stop migrants from coming and that Trump’s threat of tariffs is needed to change that….

“All this is laid bare by the sharp response to Trump’s threat that new Mexican President Claudia Sheinbaum issued Tuesday. Her statement is getting attention for its barbed claim that American guns trafficked to Mexico are fueling crime and violence there among gangs supplying U.S. markets with drugs. ‘Tragically, it is in our country that lives are lost to the violence resulting from meeting the drug demand in yours,’ Sheinbaum noted acidly, suggesting that the two countries’ interrelated national challenges underscore the need for cross-border cooperation rather than Trumpian confrontation.”

She further noted that: “You may not be aware that Mexico has developed a comprehensive policy to assist migrants from different parts of the world who cross our territory en route to the southern border of the United States. As a result, and according to data from your country’s Customs and Border Protection (CBP), encounters at the Mexico-United States border have decreased by 75% between December 2023 and November 2024….

“What this polite (and euphemistic) language says is that Mexico is already acting extensively to thwart migrants who travel through that country—originating south of Mexico—so they don’t reach our own southern border. As Sheinbaum notes, this is partly why border apprehensions in the United States have dropped sharply of late.” New Republic: “Mexico’s Sheinbaum responds to Trump tariffs”

So, what did our bully in chief do next? “President-elect Donald Trump has said he had a “wonderful” conversation with Mexico’s President Claudia Sheinbaum, in an apparent easing of the tensions raised this week over trade tariffs…. After Wednesday’s phone call, both leaders described the conversation in positive terms. Trump said on Truth Social, his social media platform, that it was a ‘very productive conversation’ and thanked Mexico for its promised efforts.”

Perpetuating his original lie, “Trump indicated that Sheinbaum would stop migration through Mexico, ‘effectively closing the southern border’.

“Sheinbaum said she had explained her country’s efforts to deal with migrants and that her position would ‘not be to close borders but to build bridges’”. https://on.ft.com/49czcol

Trump may or may not be a good negotiator (6 of his businesses have filled for bankruptcy) but his approach is that of a bully. Given America’s dominant status in the world, bullying rather than leading and negotiating in the search for mutually beneficial compromises will hasten American decline from leadership.