“Posting on his Truth Social platform, Trump said [Monday] that on the first day of his presidency he will charge Mexico and Canada a 25% tariff on all products coming into the U.S. He added in a separate social-media post that he would impose an additional 10% tariff on all products that come into the U.S. from China,… That would come on top of existing tariffs the U.S. has already imposed on Chinese goods.

“’This Tariff will remain in effect until such time as Drugs, in particular Fentanyl, and all Illegal Aliens stop this Invasion of our Country!’ Trump wrote.” WSJ: Trump pledges tariffs on Mexico Canada and China”

A tariff is a tax on an import. They are permitted by the World Trade Organization when leveed on goods receiving state subsidies in order to create a level playing field for trade. Such global trade has made an enormous contribution to the standard of living around the world. “Ernie Tedeschi, former chief economist for President Joe Biden’s Council of Economic Advisers, said the North American tariffs would cost the typical American household almost $1,000 per year.” WP: “Trump tariffs-China Mexico Canada”

The normal expectation is that the tariff will reduce U.S. demand for the taxed import and encourage its domestic production. But the US labor force is fully employed and can only increase domestic production of the targeted goods by shifting workers from the production of goods the US has a comparative advantage in thus reducing our overall income. Though employment of manufacturing workers has declined in the US, manufacturing output has not because worker productivity has increased. In fact, our imports have not shipped American jobs overseas as increasing productivity has resulted in reduced manufacturing employment most everywhere in the world, including China, surely a good thing. WC: “Trade protection and corruption”

Immediately after Trump’s tariff announcement, the exchange rate of the dollar strengthened. A stronger dollar reduces the cost of imports (but increases the cost to foreigners of our exports), thus undoing to some extent the demand reducing impact of the tariff. But it hurts our exports because of their higher price to foreign purchaser and reduces our overall standard of living.

China and others hit with this tax are likely to retaliate with their own tariffs. “Under the United States-Mexico-Canada Agreement (USMCA), which took effect in 2020, goods moving among the three North American nations cross borders on a duty-free basis. ‘Obviously, unilaterally imposing a 25 percent tariff on all trade blows up the agreement,’ said John Veroneau, a partner at Covington & Burling in Washington.” WP: “Trump tariffs-China Mexico Canada”

Should Trump actually impose these tariff’s he would (again) be violating the law, which only allows the President to impose tariffs without Congressional approval for national security reasons: WC: “Tariff abuse”

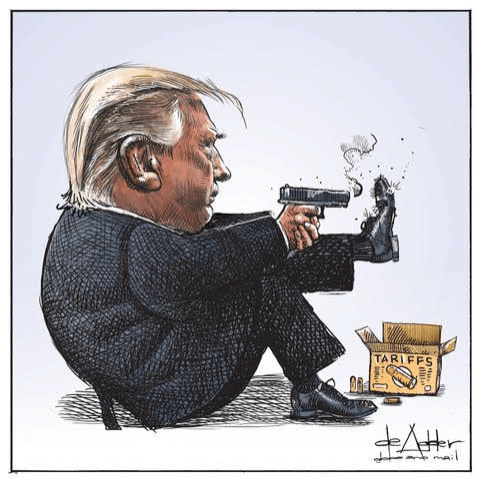

Trump’s threatened tariffs are not even leveed on the goods he wants to restrict (drugs and illegal aliens). Thus, unlike traditional tariffs they would be leveed to pressure Mexico and Canada to take other actions Trump wants. They are bargaining ploys. So at the cost of raising prices and lowering incomes in the US, weakening the global trading rules from which we have benefited so much, and weakening the checks and balances limiting an over extended executive branch, Trump may be playing his bargaining game again. But in my opinion the cost to us and the world trading system is too high.